According to NZ Post's Annual eCommerce Review, Kiwi shoppers spent over $6.09 billion online in 2024, 5% more than in 2023. Despite the tough economic conditions, which saw overall retail spending decline, shoppers made online transactions – both locally and internationally - in record levels.

There were no dramatic swings, 2024 vs 2023, just incremental expenditures from week to week throughout most of the year.

It’s a far cry from Covid-infested 2020, when disease and lockdowns saw online shopping soar.

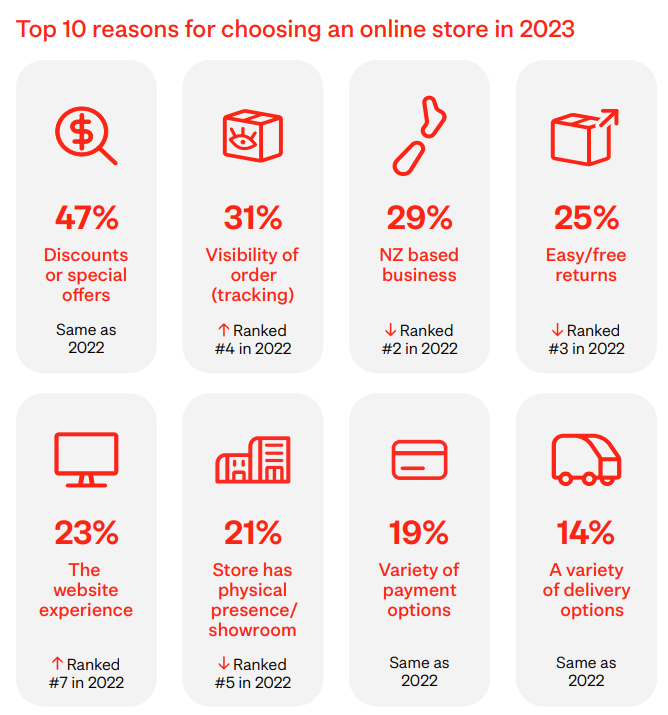

Needless to say, we’re all grateful not to have to go through pandemic-enforced requirements to do our shopping online. Nowadays, we shop online for a variety of reasons, none of them related to coronavirus compulsion:

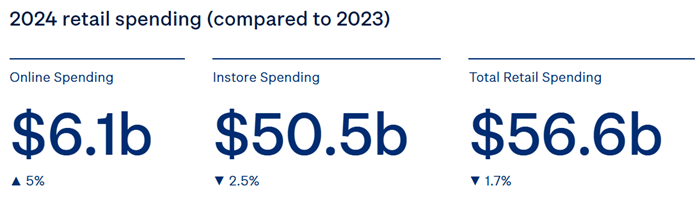

So how did online shopping in 2024 compare to instore retail? Online is steadily increasing while instore is seeing slight declines.

Online spending now represents 10.8% of total retail expenditure.

The drivers of NZ online spending in 2024

The 5% growth in online spending in 2024 was primarily driven by a 13% increase in online transactions, partially offset by a 7.5% decrease in the average online spend per transaction (average basket size). With general annual CPI inflation at 2.2%, this represents real growth in shopping spend, not just shoppers paying more to buy the same items.

TRANSACTIONS: There were more than 64.1 million online transactions in 2024, up 13% on 2023. On average there were around 175,000 online transactions every day during 2024.This is the highest number of annual online transactions we’ve seen since NZ Post started monitoring markets 6 years ago. For context, there were 42% more online transactions in 2024 than COVID-impacted 2020.

AVERAGE BASKET SIZE: The average online shopping basket was $95 in 2024, down $7.66 on 2023. Shoppers were clearly cautious with their spending, spreading their money over more transactions, prioritising essential items, and opting for discounted products and lower-cost alternatives.

ONLINE SHOPPERS: Nearly 2.2 million Kiwis (about 50% of the population aged 15 and over) shopped online in 2024. In general terms, there were more people shopping online in most months in 2024, compared to the equivalent month in 2023.

Buy Now Pay Later arrangements were also a big part of how online shoppers were able to spend more in 2024’s conditions, resulting in 19% growth in the total value of online Buy Now Pay Later transactions compared to 2023.

What Kiwis bought online in 2024

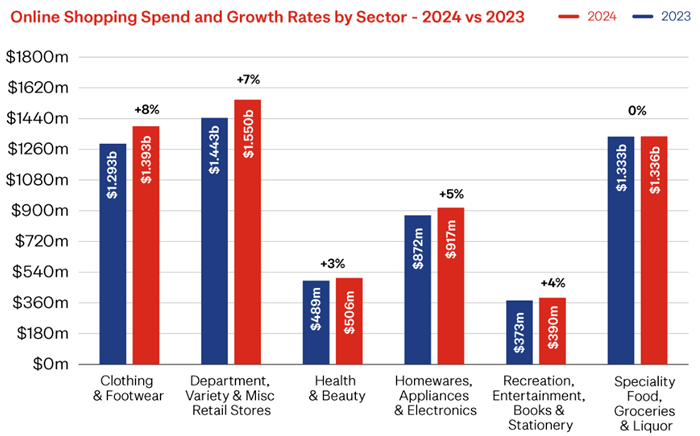

Online spending grew across nearly all sectors compared to 2023, driven by growth in transaction volumes in all sectors. Four of these sectors saw this transaction growth come from domestic retailers while international transaction volumes declined.

Department, Variety & Miscellaneous Retail stores had the fastest growth rate in international transactions (+33%), reflecting the disruptive impact of stores like Temu on Kiwis’ shopping habits. The other sector that saw international transaction growth was Speciality Food, Groceries & Liquor (+9%), suggesting the products sourced from overseas aren’t available here.

The average basket size fell for all sectors, except for Recreation, Entertainment, Books & Stationery which remained the same overall. This sector’s domestic basket grew by 7%, with the international basket size falling by the same amount.

New Zealand’s two largest online retail sectors, Clothing & Footwear (up 8%) and Department, Variety & Miscellaneous Retail (up 7%) had the fastest spending growth rates compared to 2023.

Clothing and Footwear's growth was driven by a strong increase in domestic spending (+20%) at the expense of offshore spending (-17%). The sector’s domestic transaction levels were a massive 32% up on 2023, partially offset by a 9% decline in the domestic basket size.

Growth for Department, Variety & Miscellaneous Retail Stores, New Zealand’s largest online retail sector, was dominated by overseas spending in 2024. Overall there were over 3 million more transactions in the sector compared to 2023. 55% of the sector’s transactions were with offshore retailers, compared to 47% in 2023. The average online basket size fell for both offshore and domestic retailers.

Speciality Food, Groceries & Liquor was the only sector that didn’t see growth in online spending. While overall sector spending was flat, the Grocery Stores and Supermarkets sub-sector did have growth, suggesting people are searching online for better prices on every day household essentials. This sub-sector’s growth was however matched by declines in non-essential spending in the Liquor Stores, and Convenience Stores & Specialist Markets sub-sectors. Prioritising essential, over discretionary, spending is a trend we’ve seen throughout 2024.

The remaining three sectors saw online spending grow by between 3% and 5%.

By comparison, instore spending fell across all sectors in 2024 except for Health & Beauty, which saw a 3% rise.

Who purchased online in 2024

Not surprisingly, online spending continues to be dominated by the age group with the most discretionary income (30-59), though it’s the older age groups (60+) who are experiencing the largest percentage growth in spending.

Blurred Lines: The Omnichannel Experience (and Expectations)

Nowadays, ecommerce/retail is all about "omnichannel", as shoppers move seamlessly between shopping in-store and shopping online, even within the same purchase transaction. With all the big physical retailers now having a digital presence, it’s become increasingly easy for shoppers to have an omnichannel shipping journey.

Omnichannel shopping brings together the strengths of both shopping channels. It offers the convenience and the ability to research online with the tangible physical experience of in-store.

As a result, we often see shoppers start with one channel and then finish with another. Two-thirds of shoppers look online before going to store to purchase a product. Nearly a quarter of shoppers click online and collect in-store, and one-in-five start their shopping transaction in-store and then make the purchase online.

The other interesting trend is the rise of shoppers going online while in-store. 42% of those NZ Post researchers spoke to said they did this, in order to compare prices, find product information and to read reviews.

Once upon a time, this practice was called "showrooming", and retailers HATED it and did everything they could to discourage it. It was seen as a way for shoppers to do price comparisons and (if they found better deals online) the retailer lost the sale even though the would-be shopper was right there in the store.

Not any more. Savvy retailers are embracing this trend, optimising their websites for mobile, providing QR codes in store to access information quickly, and/or providing an online guide of where to find a product in their store.

Here are the omnichannel numbers for today’s Kiwis:

Busier Than Ever Online

The way people shop online has changed a lot since the pandemic. New Zealand consumers are more comfortable with digital transactions than ever before. This shift means that even local businesses have a great chance to reach a wider audience if they adapt quickly. However, it also means that competition is growing, as more businesses move online and offer similar products and services.

Standing out in a crowded market requires real effort. It is not enough to have a basic online store; your website needs to build trust from the moment a visitor lands on it. Kiwis appreciate honesty and transparency, so being clear about who you are, what you offer, and how you handle issues like returns or customer queries is essential. This focus on trust creates an opportunity to build a loyal customer base if you can consistently deliver on your promises.

Essential Foundations for Success

Before you can begin to grow your online sales, you need to ensure that your store is built on a strong foundation. This starts with choosing the right e-commerce platform. Whether you decide on a well-known option like Shopify or WooCommerce or opt for a platform designed specifically for the New Zealand market, make sure it suits your budget, technical skills, and business needs. Take advantage of free trials and online tutorials to understand the platform’s features.

Security is another cornerstone of your online success. Setting up secure payment gateways is not just about protecting transactions—it also reassures your customers that their personal and financial information is safe. Alongside this, you should offer transparent shipping options. Clearly display costs, estimated delivery times, and any conditions such as minimum order amounts for free shipping. This level of openness helps reduce any hesitation that potential buyers might have.

In today’s market, many shoppers use their smartphones to make purchases. Therefore, it is crucial that your online store is mobile responsive and that your site speed is fast. A slow-loading or poorly formatted mobile site can drive potential customers away, so invest time in ensuring your website looks good and works well on all devices.

Key Performance Indicators (KPIs) to Monitor

To understand whether your e-commerce efforts are working, you need to track a few key performance indicators:

Conversion Rate, Average Order Value (AOV), and Customer Lifetime Value (CLV):

- Conversion Rate tells you the percentage of visitors who end up making a purchase.

- Average Order Value shows how much money, on average, each customer spends per transaction.

- Customer Lifetime Value estimates the total revenue you can expect from a customer over the duration of your relationship with them.

Monitoring these figures will help you understand what is working well and where improvements might be needed.

Cart Abandonment Rate:

This measures the percentage of shoppers who add items to their basket but leave without buying. A high abandonment rate can signal problems such as unclear shipping costs or a complicated checkout process. Practical steps to lower this rate include sending friendly email reminders, offering a simple and secure checkout process, and clearly stating your return policy.

Return on Ad Spend (ROAS) and Cost per Acquisition (CPA):

These metrics help you gauge the effectiveness of your marketing efforts. ROAS indicates how much revenue you earn for every dollar spent on advertising, while CPA tells you how much it costs to acquire a new customer. By keeping an eye on these numbers, you can make informed decisions about where to invest your marketing budget and adjust your strategies for better results.

NZ Online Buying Behaviours

The pandemic accelerated the shift to online shopping, and even in 2025, Kiwi shoppers continue to prioritise convenience and safety. Many now expect a seamless online experience, from browsing to delivery. For small NZ businesses, this means opportunities to reach customers beyond their local area, including rural regions or even overseas markets. However, challenges include keeping up with evolving customer expectations, such as faster delivery times or personalised shopping experiences.

Practical advice:

- Use social media platforms like Facebook, TikTok, Instagram or YouTube to showcase products and engage directly with customers.

- Offer flexible payment options (e.g., Afterpay, credit cards, bank transfers) to cater to diverse preferences.

- Highlight convenience factors, such as "click-and-collect" services, to appeal to busy shoppers.

Growing competition in the NZ e-commerce space and how local businesses can stand out

The NZ e-commerce market is crowded, with both local and international competitors vying for attention. Small businesses must differentiate themselves to survive.

Opportunities lie in emphasising what makes your brand uniquely Kiwi—think locally made products, sustainability, or community-focused values.

Challenges include competing with larger retailers who have bigger budgets for advertising and logistics.

Practical advice:

- Tell your brand’s story on your website. For example, if you sell handmade candles, explain how they’re crafted in Nelson using NZ beeswax.

- Partner with other small businesses for cross-promotions (e.g., a coffee roaster collaborating with a mug maker).

- Use eco-friendly packaging to appeal to environmentally conscious shoppers.

The importance of brand trust and transparency for Kiwi shoppers

Kiwi shoppers value honesty and reliability, especially after years of economic uncertainty. A lack of transparency (e.g., hidden fees or vague return policies) can drive customers away.

Opportunities include building long-term loyalty by being upfront about pricing, shipping times, and product quality.

Challenges involve maintaining consistency—every interaction with your brand must reinforce trust.

Practical advice:

- Display GST-inclusive pricing clearly on product pages to avoid surprises at checkout.

- Feature customer reviews and star ratings prominently. For example, “Rated 4.8/5 by 150 Kiwi customers.”

- Offer a no-questions-asked returns policy and state it boldly on your website (e.g., “30-Day Easy Returns”).