Are We There Yet?

We’ve been holding out for good news in 2025, and it’s coming, but not quite yet. Economic indicators and business sentiment suggest a tale of two halves: the first half bringing a sense of continuing stagnation, while the latter part of the year points to a slow build of cautious optimism. For NZ businesses, navigating this transition will require – well, read on.

Half One: Stagnation

The opening months of 2025 are likely to feel like a bit of an economic hangover. Several factors will contribute to a sense of stagnation:

Lingering Inflation & High Interest Rates: While inflation is predicted to ease from its peak, it’s expected to remain stubbornly above the Reserve Bank target band. Interest rates, while potentially having peaked, will still be elevated, impacting borrowing costs for both businesses and consumers. This translates to constrained spending power and dampened investment.

Reduced Consumer Demand: Household budgets remain squeezed by rising living costs, prompting consumers to rein in spending. The cumulative effect of sustained inflation, higher mortgage rates, and potentially slower real wage growth will squeeze household budgets. Consumer confidence is likely to remain fragile, with discretionary spending particularly vulnerable. Think twice before launching that luxury, impulse-buy campaign in H1!

Cautious Business Investment: Faced with economic uncertainty and higher borrowing costs, businesses are predicted to adopt a cautious approach to investment. Expansion plans may be put on hold, and investment will likely focus on essential upgrades, efficiency gains, and technological adoption rather than large-scale growth initiatives.

Global Economic Headwinds: New Zealand, as a trading nation, is not immune to global economic currents. Predictions for global growth in early 2025 are generally muted, with ongoing geopolitical uncertainties and potential trade tensions casting shadows. This impacts export demand and overall economic sentiment. The Trump 2.0 administration is another highly volatile contributor to confusion all around.

Labour Market Adjustment: While unemployment is expected to remain relatively low by historical standards, the exceptionally tight labour market of recent years is predicted to loosen slightly. This could lead to increased competition for jobs and a moderating of wage growth, further impacting household spending power.

The Transition: Signs of Recovery

Despite the sluggish start, mid-2025 is forecast to see the first glimmers of recovery. Easing supply chain bottlenecks, a potential stabilisation of global commodity prices, and an uptick in tourism — bolstered by new travel corridors and relaxed international restrictions — could shift the narrative.

A gradual increase in consumer confidence, combined with improved economic sentiment, offers marketers a pivotal window to realign strategies. This is where agility and responsiveness become essential. Brands that remain overly cautious, failing to anticipate renewed demand, risk losing market share to competitors ready to seize emerging opportunities.

Half Two: Cautious Optimism

Boosting Business Sentiment

By the second half of 2025, many economic forecasters suggest a measured return to growth. Tourism, a critical pillar of New Zealand’s economy, is likely to regain lost ground, while sustained innovation in tech and agritech could bolster the country’s position as a savvy exporter of high-value, sustainable products.

Key factors driving optimism:

Inflation Moderation: The cumulative effect of RBNZ’s monetary policy tightening and easing global supply chain pressures is expected to bring inflation more firmly under control. While still above target, a visible downward trend could improve sentiment.

Potential Interest Rate Relief: If inflation shows convincing signs of easing, the RBNZ may begin to signal or even implement a gradual easing of interest rates in the latter part of the year. This could provide a much-needed boost to business and consumer confidence and stimulate borrowing and spending.

Tourism Sector Recovery Continues: The tourism sector, a vital pillar of the NZ economy, is predicted to continue its recovery trajectory. While reaching pre-pandemic levels might still be a distance away, sustained growth in international arrivals will provide a significant economic injection, particularly for tourism-dependent regions and businesses.

Resilient Core Sectors: Sectors like agriculture and technology are expected to demonstrate continued resilience. While agriculture will face ongoing challenges (climate change, global commodity prices), it remains a robust export earner. The technology sector is predicted to maintain growth momentum, driven by digital transformation and export opportunities in niche areas.

Implications for NZ Marketers: A Tightrope Walk

This ‘year of two halves’ scenario presents a complex and demanding environment for New Zealand marketers. It’s a tightrope walk, requiring them to be both pragmatic and proactive, cautious yet creative. The implications are clear:

Budget Scrutiny & ROI Focus: Marketing budgets will likely face increased scrutiny. Marketers must demonstrate clear return on investment (ROI) for every campaign and justify every expenditure. Vanity metrics will be out; tangible results will be king.

Value-Conscious Consumers: Consumers will be even more value-conscious and discerning. They will be seeking quality, durability, and tangible benefits for their reduced disposable income. Marketing messages must resonate with this practicality and demonstrate real value.

Increased Competition for Share of Wallet: With constrained consumer spending, competition for share of wallet will intensify. Marketers will need to be sharper, more creative, and more targeted to stand out and capture attention.

Digital Dominance & Efficiency: Digital marketing channels will become even more crucial due to their cost-effectiveness and targeting capabilities. Marketers must leverage data analytics, automation, and digital platforms to maximise reach and efficiency within tighter budgets.

Brand Trust & Authenticity Imperative: In times of economic uncertainty, brand trust and authenticity become paramount. Consumers will gravitate towards brands they trust and perceive as genuine and reliable. Greenwashing and empty promises will be swiftly penalised.

Challenges for Marketers: Navigating the Headwinds

Cutting Through the Economic Noise: Economic uncertainty and negative news cycles can create a sense of consumer paralysis. Marketers need to find ways to cut through this noise and engage audiences effectively.

Maintaining Brand Momentum During Stagnation: The first half of the year will be about maintaining brand visibility and engagement without overspending. Sustaining momentum through a period of stagnation requires strategic planning and efficient resource allocation.

Balancing Value Messaging with Brand Aspirations: While value messaging is crucial, brands still need to maintain their aspirational appeal and avoid cheapening their image. Finding the right balance between value and brand positioning will be key.

Adapting to Shifting Consumer Sentiment: Consumer sentiment can be volatile and reactive to economic news. Marketers need to be agile and responsive, constantly monitoring consumer mood and adjusting messaging accordingly.

Balancing Prudence and Boldness: While renewed consumer confidence suggests opportunities for brand expansion, external shocks (e.g. new variants of global health threats, sudden commodity price hikes, or geopolitical tensions) could still derail optimism. Marketers must balance a willingness to invest in growth with contingency plans for unforeseen setbacks.

Staying Ahead of Regulatory Changes: As digitalisation accelerates, so too does regulatory scrutiny around data privacy and AI-driven marketing. New Zealand’s legislators may introduce tighter guidelines on personal data handling, pushing marketers to adopt robust compliance strategies. Maintaining consumer trust will be paramount.

Overcoming Talent Gaps: Many NZ organisations continue to face labour shortages in tech and digital marketing roles. Competition for skilled marketers and data analysts remains fierce, driving up recruitment and retention costs. Prioritising workplace culture, professional development, and flexible working arrangements is crucial in attracting top talent.

Finding the Silver Linings

Within these challenges lie significant opportunities for astute marketers:

Strengthening Customer Loyalty: Focusing on customer retention and loyalty programmes becomes incredibly valuable. Loyal customers are more resilient during economic downturns and provide a stable revenue base.

Emphasising Value & Quality: The value-conscious consumer presents an opportunity to highlight quality, durability, and long-term benefits. Brands that can demonstrably offer superior value will gain a competitive edge.

Digital Innovation & Efficiency Gains: The push for digital efficiency can drive innovation and improve marketing ROI. Marketers can leverage technology to optimise campaigns, personalize customer experiences, and reach target audiences more effectively.

Building Brand Trust & Community Connection: Brands that focus on building genuine trust and community connection can differentiate themselves in a competitive market. Highlighting local roots, ethical practices, and social responsibility can resonate strongly with consumers.

Agility & Adaptability as a Competitive Advantage: The ability to be agile, adaptable, and responsive to changing market conditions becomes a significant competitive advantage. Marketers who can quickly adjust strategies and capitalise on emerging opportunities will thrive.

Focus on Niche & Growth Sectors: While some sectors will struggle, others like technology, sustainable businesses, and potentially parts of tourism will offer growth opportunities. Marketers can strategically focus on these niche markets.

Strategic Positioning for NZ Marketers in 2025

To navigate the ‘year of two halves’ successfully, NZ marketers should position themselves and their organisations with the following strategies in mind:

Lead with Value, Not Just Price: Emphasise quality, durability, functionality, and long-term benefits over simply offering the lowest price. Demonstrate the value proposition clearly and convincingly.

Prioritise Customer Retention & Loyalty: Invest in CRM, personalisation, loyalty programmes, and exceptional customer service. Make existing customers feel valued and appreciated.

Become Digital Masters (Efficiency & Data-Driven): Maximise digital marketing channels. Leverage data analytics to understand campaign performance, refine targeting, and optimise ROI. Explore marketing automation tools for efficiency gains.

Craft Empathetic & Authentic Messaging: Adopt a tone that is sensitive to the economic climate. Focus on themes of resilience, practicality, community support, and genuine connection. Avoid aspirational or tone-deaf messaging.

Innovate Strategically, Not Recklessly: Explore new product/service offerings or adapt existing ones to meet evolving needs and potentially offer more value-focused options. Focus on strategic innovation that aligns with market demands.

Embrace Agility & Scenario Planning: Develop contingency plans and be prepared to adjust marketing strategies quickly in response to economic shifts or changes in consumer behaviour. Implement a test-and-learn approach and monitor economic indicators closely.

Focus on Building Brand Trust & Transparency: Communicate honestly, reliably, and transparently. Highlight ethical practices, sustainability initiatives, and community involvement to build trust and differentiate your brand.

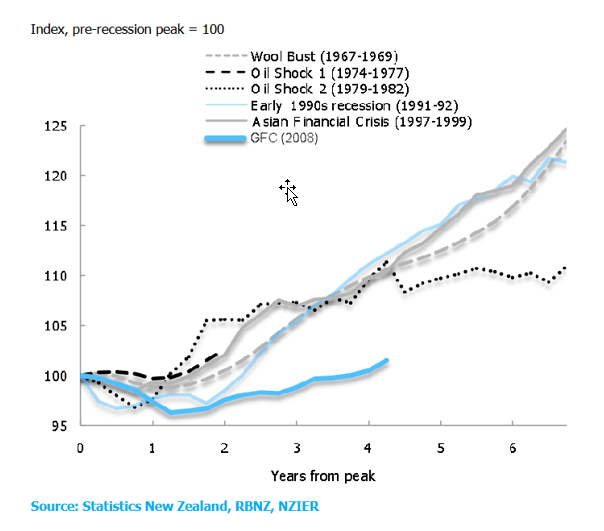

We’ve Been Here Before

Yeah, this ain’t new, for those of us marketers who are a little long in the tooth. We've seen similar pain during the Global Financial Crisis (2008), recessions in the 1990s, the oil shocks of the 1970s and as far back as the wool bust of the late 1960s.

So – learn from the past or be doomed to repeat it, right?

A recession or two ago, we developed a workshop, “Thriving Through a Recession”, specifically for marketers. If you’re interested in learning more, and possibly taking part in the updated 2025 version, email us at info@netmarketingcourses.co.nz