Key New Zealand Digital Marketing Trends for 2025

Executive Summary: Navigating the 2025 Digital Marketing Terrain in New Zealand

Digital marketing in New Zealand is in constant motion, and as 2025 unfolds, it presents a dynamic environment for businesses and marketers. To maintain a competitive edge, staying abreast of the latest marketing trends is essential. The interplay of ongoing economic pressures, shifts in consumer behaviour, and the ever-increasing influence of technologies such as AI are shaping how businesses connect with their audiences.

The current economic climate, marked by both contraction and projected recovery, necessitates a nimble approach to digital marketing.

Simultaneously, the rapid advancements in technology, particularly in artificial intelligence, offer unprecedented opportunities for personalisation and operational efficiency. For marketers in New Zealand, understanding this intersection is paramount to crafting effective strategies.

Furthermore, NZ's unique market characteristics, including its high rate of digital adoption, create both a fertile ground for online engagement and a competitive arena where standing out requires insightful and tailored approaches. With a significant portion of the population actively engaging online, the potential reach for digital marketing is substantial [1].

However, this also means that Kiwis are exposed to a multitude of marketing messages, underscoring the need for compelling and relevant content to capture their attention [1].

Key Marketing Statistics for New Zealand in 2025: A Snapshot

To provide a clear overview of the digital marketing landscape in New Zealand, the following table presents key statistics:

Table: Key Digital Usage Statistics in New Zealand (2024-2025)

|

Metric |

Early 2024 Value |

Early 2025 Value |

Year-on-Year Change (%) |

|

Internet Users |

5.03 million |

5.03 million |

0.0 |

|

Internet Penetration Rate |

95.7% |

96.2% |

+0.5 |

|

Social Media Users |

4.13 million |

4.14 million |

+0.2 |

|

Social Media Penetration Rate |

78.7% |

79.1% |

+0.4 |

|

Mobile Connections |

6.18 million |

6.03 million |

-2.5 |

|

Mobile Connections as % of Population |

118% |

115% |

-3.0 |

Source: DataReportal Digital 2024 & 2025 New Zealand Reports [1]

The data shows a consistently high level of internet penetration in NZ, reaching 96.2% of the population in early 2025 [1]. Similarly, social media usage remains robust, with 79.1% of Kiwis identified as social media users [1].

This near-universal internet access establishes digital marketing as a primary avenue for businesses to connect with the majority of consumers. With such a significant portion of the population engaging online, New Zealand businesses have a substantial opportunity to reach their **target audience** through various digital marketing techniques, ranging from optimising for search engines to implementing engaging social media campaigns. A strong online presence is therefore crucial for all businesses operating in New Zealand.

Interestingly, while internet and social media usage have either remained stable or seen slight growth, the number of active mobile connections has decreased by 2.5% between early 2024 and early 2025 [1].

While the mobile connection rate remains high at 115% of the total population, it is important to note that a small number of these connections only include voice and SMS services, without access to the internet [1].

This subtle shift suggests that while mobile devices are ubiquitous, marketers should increasingly focus their digital marketing strategies on internet-enabled mobile usage, targeting those using smartphones and mobile internet for browsing and social media. The slight decrease in overall mobile connections might indicate a move towards fewer, more comprehensive mobile plans or the increasing dominance of smartphone usage over basic mobile phones. This has implications for mobile-first marketing strategies, suggesting that optimising for smartphone experiences and considering in-app messaging or social media engagement on mobile might be more relevant than traditional SMS marketing.

Economic Pressures and Their Impact on Marketing in New Zealand in 2025

Navigating the Economic Climate: Challenges and Opportunities for Marketers

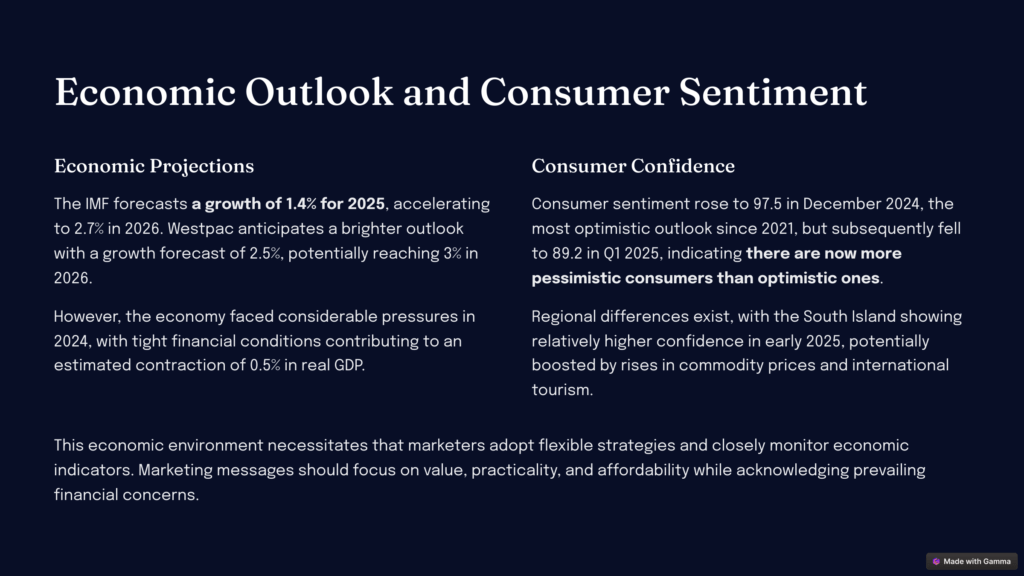

The economic outlook for New Zealand in 2025 presents a mixed picture. While the latest NZIER Consensus Forecasts suggest a contraction of -0.8% in the year ending March 2025, largely due to revised GDP data for 2024, projections for the remainder of 2025 indicate a potential rebound [2].

The International Monetary Fund (IMF) forecasts a growth of 1.4% for 2025, accelerating to 2.7% in 2026 3. Similarly, Westpac anticipates a brighter economic outlook for 2025, with a growth forecast of 2.5%, potentially reaching 3% in 2026 [4].

In 2024, the NZ economy faced considerable economic pressures. Tight financial conditions contributed to an estimated contraction of 0.5% in real GDP [3]. Household spending was curtailed by a second consecutive year of declining real disposable income per capita [3]. Concerns regarding the political climate in New Zealand and a weakening global economic outlook have also been noted, potentially dampening the momentum for increased business investment [5].

Furthermore, the potential for a global trade war introduces an element of uncertainty to the economic landscape [4]. This complex economic environment, characterised by initial contraction followed by anticipated growth, necessitates that marketers in adopt flexible strategies and closely monitor economic indicators. The divergence in economic forecasts means that relying on a single prediction is unwise. Having contingency plans and the ability to quickly adapt campaigns to shifting economic realities will be crucial for navigating the marketing landscape successfully. This might involve adjusting messaging to focus on value during periods of economic caution and highlighting aspirational themes if a strong economic recovery materialises.

The persistent economic pressures on households will likely lead to continued price sensitivity among consumers. Therefore, marketers should place a strong emphasis on the value proposition of their products and services and consider incorporating promotions and discounts to attract and retain customers.

With rising costs of living, consumers are expected to be more discerning about their spending. Marketing messages that clearly articulate the benefits and offer competitive pricing or special deals will be more effective in driving conversions. This could also entail a greater focus on the essential attributes of products and services rather than solely relying on aspirational marketing.

Demonstrating a clear return on investment for marketing efforts will also be crucial. Given the financial constraints faced by both consumers and businesses, marketing spend will likely be under scrutiny, requiring marketers to justify their budgets by showcasing tangible results and efficient resource allocation.

Consumer Sentiment in New Zealand: December 2024 and Early 2025

Consumer sentiment in New Zealand experienced notable shifts around the turn of the year. The Westpac McDermott Miller Consumer Confidence Index saw a significant rise to 97.5 in December 2024, marking the most optimistic outlook among NZ households since 2021 [7]. This uplift was largely attributed to easing inflation and falling mortgage rates, which provided some relief from the financial strains of recent years [7.]

However, this optimism proved to be somewhat fleeting, as the index subsequently fell to 89.2 in the first quarter of 2025, the lowest level recorded since the second quarter of 2024 [10]. This decline was attributed to escalating global trade tensions and persistent cost-of-living pressures, indicating that underlying economic anxieties continue to weigh on Kiwis [10].

Notably, consumer confidence levels varied across different regions. In December 2024, Auckland displayed a more buoyant mood, while Wellington experienced a dip in confidence [7]. By early 2025, the South Island showed relatively higher confidence, potentially boosted by rises in commodity prices and international tourism [10].

The decline in consumer sentiment in early 2025 suggests that the initial optimism may have been a temporary reprieve, and marketers should exercise caution and avoid overly positive messaging. The continued strain of the economic environment means that marketing campaigns should acknowledge these concerns and focus on providing value or solutions that address current needs rather than assuming a return to high levels of spending.

Furthermore, the regional differences in consumer sentiment underscore the importance for marketers to consider localised approaches. Regions with stronger economic drivers might be more receptive to certain types of marketing, suggesting that tailoring campaigns to the specific economic conditions and consumer mood in different parts of New Zealand could lead to better engagement and conversion rates.

Understanding the New Zealand Consumer in 2025

Evolving Consumer Behaviour and Online Spending Habits

Studies indicate that Kiwis are increasingly integrated into the online world, with a significant amount of their leisure time spent on the internet. Research commissioned by InternetNZ found that 50% of respondents spend four or more hours of their free time online each day [13]. This trend is particularly prevalent among younger demographics, with 67% of 18-29 year olds reporting such high levels of online engagement [13]. The most popular online activities include engaging with social media, managing emails, streaming television shows, and reading news online [13].

Despite the prevailing economic challenges, online spending in New Zealand continues to grow. Data from NZ Post Business IQ reveals that Kiwis spent $1.39 billion online on physical goods in the first quarter of 2024, representing a 2% increase compared to the same period in 2023 [14].

This growth occurred even though the average amount spent per online transaction decreased by 14% to $93, suggesting that consumers are making more frequent purchases but are more selective about what they buy in each transaction [14].

There is a strong preference for local retailers, with 75% of online spending in Q1 2024 directed towards NZ-based businesses [14]. Insights from Shippit also suggest that New Zealand consumers are prioritising value-driven purchases, saving up for significant items during sales events [15].

The average order value declined throughout 2024, but saw a considerable increase during events like Cyber Weekend [15]. The significant time New Zealanders dedicate to online activities presents a substantial and expanding opportunity for digital marketing to reach and engage them across various platforms and online pursuits.

With consumers spending a considerable portion of their day online, businesses have numerous channels to connect with them through targeted content, social media interaction, and online advertising. This necessitates a comprehensive online strategy that takes into account the diverse ways consumers are engaging with the digital landscape.

Furthermore, the evident preference for local retailers in online spending indicates a strong sense of national pride and offers a potential advantage for New Zealand businesses to highlight their local connections and support for the national economy in their marketing. Emphasising local sourcing, community involvement, and an understanding of local needs can be a powerful differentiator and resonate with consumers who prioritise supporting local enterprises.

The trend of more frequent online purchases with smaller basket sizes, alongside the focus on sales events, suggests that New Zealand consumers are becoming more discerning and strategic in their online shopping habits, actively seeking value and timing their purchases around promotional offers. Marketers should adapt to this behaviour by offering competitive pricing, discounts, and clearly communicating upcoming sales opportunities.

Preferences for Online Experiences: Personalisation and Sustainability

The expectations of New Zealand consumers regarding online experiences are evolving, with a growing emphasis on personalisation and sustainability. According to Click n Call, AI-driven personalisation is no longer a luxury but a fundamental requirement in e-commerce [16]. Consumers increasingly expect tailored product recommendations and instant customer support through AI-powered chatbots [16].

Mobile commerce continues its dominant trajectory, making it crucial for businesses to ensure a seamless and optimised mobile experience for their online platforms [16].

Furthermore, a report by NZMP highlights the increasing importance of sustainability and ethical considerations in the purchasing decisions of New Zealand consumers [17]. They are actively seeking natural products and are willing to pay a premium for higher quality and convenience.

There is also a growing tension between the desire for value for money and the values that consumers hold, with over 30% of digital consumers inclined to buy from brands that support social and political issues aligned with their own [17].

Shippit's data further supports this trend, indicating that sustainability plays a role in the purchase decision for over 50% of shoppers [15]. New Zealand consumers are increasingly expecting personalised online interactions driven by data and AI.

Marketers should invest in technologies and strategies that facilitate tailored content, product recommendations, and customer service. Generic marketing is becoming less effective as consumers are bombarded with information and are more likely to engage with brands that demonstrate an understanding of their individual needs and preferences.

Leveraging AI for personalised recommendations, implementing chatbots for immediate support, and delivering targeted content based on browsing history can significantly enhance customer engagement and foster loyalty.

The strong focus on sustainability and ethical consumption presents a significant opportunity for New Zealand businesses to align their brand values with those of their customers. Marketing efforts should transparently communicate sustainable practices, the use of eco-friendly packaging, and ethical sourcing of materials to resonate with this expanding consumer segment.

This requires more than just superficial claims; it demands authentic and verifiable sustainable practices integrated throughout the entire business operation. The continued prevalence of mobile commerce underscores the critical importance of providing a seamless and user-friendly mobile experience across all facets of digital marketing, from initial website browsing to the final purchasing process.

With the majority of online shoppers using mobile devices, businesses that do not prioritise the optimisation of their websites and online stores for mobile platforms risk losing a substantial portion of their potential customer base. This includes ensuring responsive design, fast loading speeds, intuitive navigation, and mobile-friendly payment options.

Key Digital Marketing Channels in New Zealand: Statistics and Trends

Social Media Marketing in NZ: Platform Popularity and Engagement

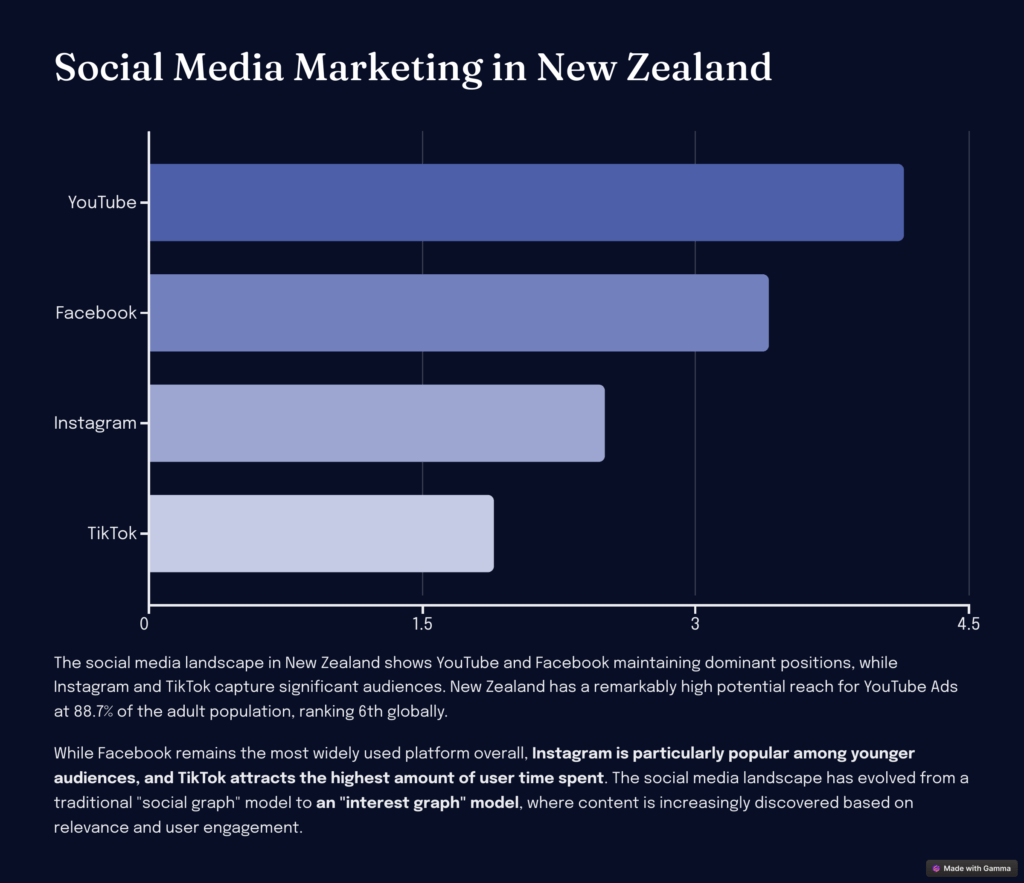

Understanding the social media landscape in New Zealand is crucial for marketers looking to connect with their target audience. Data from DataReportal in January 2025 shows YouTube reporting 4.14 million users, equivalent to the total number of social media users, suggesting variations in data collection methodologies [1].

According to DataReportal, Facebook has 3.40 million users, Instagram 2.50 million, and TikTok 1.89 million users aged 18 and above [1].

SocialMedia.org.nz observes that while Facebook remains the most widely used platform overall, Instagram is particularly popular among younger audiences, and TikTok attracts the highest amount of user time spent [19].

NZIE highlights that New Zealand has a remarkably high potential reach for YouTube Ads, at 88.7% of the adult population, ranking 6th globally [21]. LinkedIn also boasts a significant advertising reach in NZ, estimated at over 75% of the population [21]. Interestingly, Instagram has seen a notable drop in engagement rates for business pages [21].

The social media landscape has also evolved from a traditional "social graph" model, where content primarily reached followers, to an "interest graph" model, where content is increasingly discovered based on relevance and user engagement [20].

The varying user numbers across different sources underscore the importance for marketers to consider the methodologies employed in data collection. Nevertheless, the consistent message is that Facebook remains a dominant social media platform in New Zealand, providing a broad reach. However, YouTube and Instagram offer substantial reach as well, particularly among specific demographics.

TikTok's high user engagement suggests its potential for certain content formats and target audiences. Marketers should therefore adopt a platform-specific strategy, recognising the unique strengths and demographics associated with each social media channel.

A uniform approach is unlikely to be effective; instead, tailoring content and engagement strategies to align with the characteristics of each platform will maximise reach and impact. The observed decline in engagement rates on Instagram for business pages indicates that organic reach is becoming more challenging. Consequently, marketers may need to shift their focus towards creating high-quality, compelling content that truly resonates with users and potentially consider leveraging Instagram's paid advertising features to ensure visibility on the platform. Simply maintaining a presence on Instagram is no longer sufficient; businesses need to actively work to cut through the increasing noise and connect meaningfully with their audience.

The high advertising reach of both YouTube and LinkedIn in New Zealand presents valuable opportunities for marketers to target specific demographics and professional segments effectively. YouTube's extensive reach, particularly among adults, makes it a powerful platform for video advertising campaigns. LinkedIn's significant penetration within the working population makes it an ideal channel for B2B marketing initiatives and for connecting with professionals across various industries.

Email Marketing Performance in New Zealand: Strategies for Success

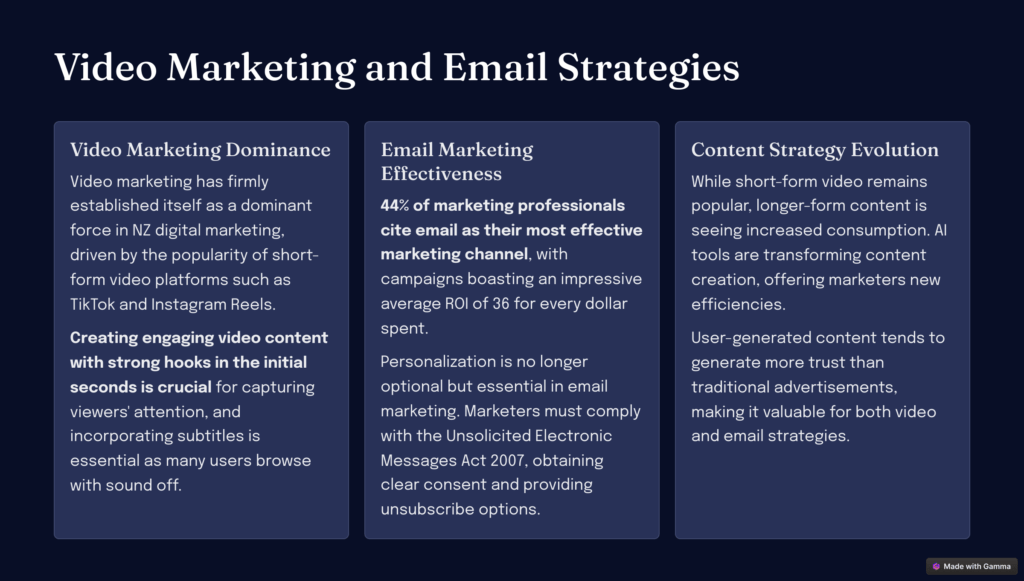

Email marketing remains a vital component of digital marketing in New Zealand, offering a direct and often highly effective way to communicate with customers. Sprintlaw's guide emphasises the legal framework governing email marketing in New Zealand, primarily the Unsolicited Electronic Messages Act 2007, which mandates obtaining clear consent from recipients before sending marketing emails [22].

Businesses must also clearly identify themselves as the sender and provide a straightforward and accessible method for recipients to unsubscribe from future communications [22]. Adhering to these regulations, along with having a robust Privacy Policy, is crucial for maintaining trust and avoiding legal repercussions [22].

Shopify's data highlights the continued effectiveness of email marketing, with 44% of marketing professionals citing it as their most effective marketing channel [23]. Furthermore, email marketing campaigns boast an impressive average return on investment (ROI) of 36 for every dollar spent [23].

The performance of email marketing can be significantly enhanced through personalisation and subscriber segmentation, allowing marketers to deliver targeted messages to specific audience groups [23]. Key metrics for evaluating the success of email marketing campaigns include open rates, click-through rates (CTR), and conversion rates, which provide insights into audience engagement and the effectiveness of the email content [23].

Despite the emergence of newer digital marketing channels, email marketing continues to be a highly effective tool in New Zealand, offering a strong return on investment. It allows for direct and personalised communication with customers, making it a valuable asset in the marketing mix. However, marketers must prioritise ethical practices and ensure full compliance with New Zealand's email marketing laws to maintain consumer trust and avoid potential legal issues.

Personalisation is no longer an optional tactic but an essential expectation in email marketing. Marketers should leverage available data on customer behaviour and their journey to create highly relevant and engaging email campaigns that lead to significantly improved results. Generic, mass emails are increasingly likely to be ignored or marked as spam.

By tailoring email content to individual customer preferences, past interactions, and their current stage in the customer journey, marketers can substantially increase open rates, clicks, and ultimately, conversions. Consistently monitoring key performance indicators such as open rates, CTR, and conversion rates is vital for assessing the success of email marketing campaigns and identifying areas where improvements can be made. Tracking these metrics provides valuable feedback on what resonates with the audience and what does not, enabling marketers to continuously refine their strategies and optimise their email marketing efforts for better outcomes.

Video Marketing Trends in NZ: Engaging Kiwi Audiences

Video marketing has firmly established itself as a dominant force in the digital marketing landscape, and this trend is particularly evident in New Zealand. Rank Rush identifies video marketing dominance as one of the top NZ digital marketing trends for 2025, driven by the popularity of short-form video platforms such as TikTok and Instagram Reels [27].

Shopify's insights highlight the ongoing importance of short-form video for quick user engagement, but also note the increasing consumption of longer-form video content [28]. The rise of AI tools is also transforming video creation, offering marketers new efficiencies [28].

Regardless of length, creating engaging video content with strong hooks in the initial seconds is crucial for capturing viewers' attention [28]. Given that a significant portion of users browse social media with the sound off, incorporating subtitles and visual titles is essential for ensuring the message is conveyed effectively [28].

Furthermore, consumers tend to trust user-generated content over traditional advertisements, making it a valuable asset in a video marketing strategy [28]. Momentum observes that New Zealand businesses are increasingly investing in video marketing not only for brand awareness but also for driving conversions, with live streaming and interactive video content gaining traction [30].

Video marketing has become an indispensable element of a successful digital marketing strategy in New Zealand in 2025. Marketers must actively incorporate video across a variety of formats and platforms to effectively engage with their target audience. New Zealanders are highly engaged with video content across numerous online channels, and businesses that do not leverage this medium risk missing out on significant opportunities to connect with their customers, enhance brand recognition, and drive conversions. While short-form video remains highly popular for its ability to quickly grab attention, the increasing consumption of longer-form content presents an opportunity for marketers to develop more detailed and compelling narratives, such as explainer videos, tutorials, and behind-the-scenes glimpses.

A well-rounded video marketing strategy should therefore encompass both short and long formats to cater to diverse consumption preferences and platform requirements. The growing availability of AI tools provides New Zealand marketers with the potential to produce high-quality video content more efficiently. These tools can assist with various aspects of video creation, from generating initial ideas and writing scripts to adding captions and performing smart editing, ultimately saving time and resources. However, it remains crucial to ensure that the final video content maintains authenticity and is tailored to the specific cultural nuances and preferences of the local NZ audience to achieve maximum resonance.

The Growing Role of AI in New Zealand Digital Marketing

Artificial Intelligence: Transforming Marketing Tasks and Customer Experiences

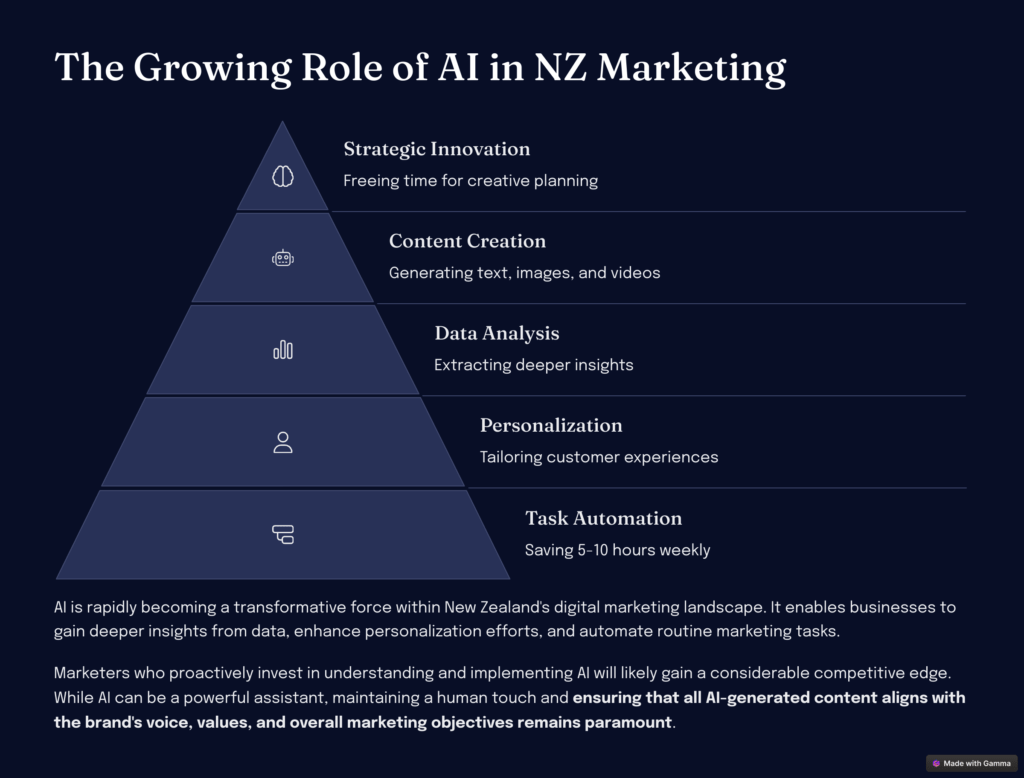

Artificial intelligence (AI) is rapidly becoming a transformative force within the digital marketing landscape of New Zealand. Mogul.nz highlights that AI has emerged as a significant game-changer, enabling businesses to gain deeper insights from data, enhance personalisation efforts, and automate various routine marketing tasks [31]. This includes the increasing use of ai-powered chatbots, such as Ambit ai, to improve customer service and engagement, as well as the implementation of AI in programmatic advertising to optimise ad spend and targeting [31].

NZIE estimates that the successful implementation of AI tools can save marketers an average of 5-10 hours per week on routine tasks, freeing up valuable time for strategic planning and creative innovation [32].

Artificial intelligence is transitioning swiftly from a futuristic concept to a practical and increasingly essential tool for New Zealand marketers, offering significant advantages in terms of efficiency gains, enhanced personalisation capabilities, and improved data-driven decision-making. Marketers who proactively invest in understanding and implementing AI will likely gain a considerable competitive edge by automating time-consuming tasks, extracting deeper insights from vast amounts of data, and delivering more engaging and tailored customer experiences.

The emphasis on AI tools like ChatGPT and other generative AI technologies underscores the growing importance of AI in content creation. New Zealand marketers can now leverage these advanced tools to generate compelling text, high-quality images, and even engaging videos more efficiently, thereby freeing up their time and resources to focus on higher-level strategic initiatives.

However, it is crucial to remember that while AI can be a powerful assistant, maintaining a human touch and ensuring that all AI-generated content aligns with the brand's voice, values, and overall marketing objectives remains paramount.

The increasing availability of specialised training courses and companies within New Zealand that focus on applying AI to marketing indicates a growing awareness and adoption of this transformative technology within the local industry (eg our own "AI for Marketers" and "AI for Advertising Professionals" online training courses).

This suggests that marketers who do not embrace AI and explore its potential applications risk falling behind their competitors who are already leveraging these tools to enhance their marketing efforts.

New Zealand Digital Ad Spend: Insights from 2024 and Projections for 2025

Analysing Ad Spend Trends and Future Outlook

Data from Nielsen Ad Intel reveals that advertising expenditure across New Zealand's Investment, Finance, and Banking sector saw a 4.1% year-on-year increase, reaching $295.3 million between February 2024 and January 2025 34. Within this sector, banks remained the largest advertisers, investing $179.5 million, while finance and investment companies experienced the most significant growth at 18% [34].

Nielsen Ad Intel's 2024 Advertising Spend Report provides a broader overview, indicating that retail, food, and telecommunications industries continued to dominate overall ad spend in New Zealand [36].

However, the report also highlighted substantial year-on-year growth in ad spend from the pharmaceuticals (+39%) and fire & general insurance (+35%) sectors, as well as a significant increase from supermarkets (+21%) 36. The advertising categories with the highest investment in 2024 included fast food, restaurants & cafes ($293 million), supermarkets ($194 million), and banks ($180 million) [36].

MAGNA Global Ad Forecasts suggest that both the Australian and New Zealand ad markets maintained growth throughout 2024, with a strong emphasis on digital-first marketing strategies inNZ, where social media and search platforms lead in terms of ad spend [39].

The continued growth in ad spend in New Zealand during 2024, despite prevailing economic uncertainties, demonstrates the resilience of the advertising market and the recognition among businesses of the importance of connecting with consumers. The notable increase in sectors like pharmaceuticals and insurance likely reflects heightened competition within these industries and a strategic focus on messaging related to health and financial security in the current environment.

This suggests that marketers in these areas are likely observing a positive return on investment from their increased advertising activities and are adapting their strategies to align with evolving consumer needs and market dynamics. The consistent dominance of retail, food, and telecommunications in overall ad spend underscores the fundamental importance of these sectors to the New Zealand economy and highlights the intense competition that exists within these markets.

Marketers operating in these industries need to employ particularly strategic and innovative approaches to differentiate their brands and capture consumer attention. Given that these sectors cater to essential consumer needs, they tend to see consistent and significant advertising investment. Marketers in these highly competitive areas must therefore focus on creating compelling differentiation, offering strong value propositions, and implementing effective targeting to secure and grow their market share.

The alignment of New Zealand's advertising trends with those in Australia, along with the clear emphasis on digital-first strategies where social media and search platforms lead in ad spend, strongly indicates that marketers in New Zealand should continue to prioritise these digital channels in their 2025 ad spend allocation.

New Zealand's advertising landscape is increasingly mirroring global trends with a significant shift towards digital platforms. Marketers should strategically allocate a substantial portion of their budgets to social media and search engine marketing initiatives to effectively reach their target audience where they are spending the majority of their time online.

Consumer Sentiment in New Zealand: Implications for Marketers

Understanding the Mood of Kiwi Consumers in 2025

As previously discussed, the Westpac McDermott Miller Consumer Confidence Index in New Zealand experienced a rise in December 2024 before declining in the first quarter of 2025 7. The drop to 89.2 in Q1 2025 signifies that there are now more pessimistic consumers than optimistic ones in New Zealand [11].

Lower consumer sentiment typically translates to reduced discretionary spending and increased caution when it comes to making significant purchases [8]. The recent downturn in consumer sentiment suggests that New Zealand marketers should consider adopting a more cautious and empathetic tone in their marketing communications.

Marketing messages that focus on the value, practicality, and affordability of products and services, while acknowledging the prevailing financial concerns of consumers, are likely to be more effective than campaigns that emphasise aspirational or luxury themes. When consumers are feeling less confident about the overall economy and their personal financial situations, they tend to be more selective and prudent with their spending.

Marketing messages that directly address these concerns by offering tangible solutions or highlighting the long-term value and necessity of a product or service are more likely to resonate positively. While overall consumer sentiment has weakened, the regional variations observed, such as the stronger sentiment reported in the South Island during early 2025, underscore the importance of considering local economic conditions and the prevailing consumer mood when tailoring marketing campaigns. A uniform marketing strategy applied across the entire country may not yield optimal results.

Marketers should consider segmenting their audience geographically and adapting their messaging and offers to align with the specific circumstances and sentiment within different regions of New Zealand. The increase in the number of people who believe it is currently a bad time to make major purchases indicates that marketers of high-value products may need to offer more compelling incentives, flexible financing options, or focus on clearly communicating the long-term benefits and durability of their offerings to overcome consumer hesitancy and encourage sales.

Consumers are more inclined to postpone or reconsider significant expenditures when their confidence levels are low. To stimulate these types of sales, marketers need to provide strong justifications for the investment, such as highlighting the product's longevity, its overall cost-effectiveness over time, or by providing attractive and accessible payment plans.

Successful Marketing Strategies for Businesses in New Zealand in 2025

Adapting to the Evolving Digital Landscape: Key Strategies for NZ Marketers

To thrive in the evolving digital marketing landscape of New Zealand in 2025, businesses should adopt a range of successful strategies. Traction Marketing recommends combining the power of Google Ads with effective SEO to ensure strong visibility in search engine results [24].

Creating and actively managing a Google Business Profile is also crucial for local businesses to enhance their online presence and attract local customers [24]. Encouraging satisfied customers to leave online ratings and reviews is essential for building trust and credibility [24].

Utilising remarketing techniques can effectively re-engage customers who have previously shown interest in a business's offerings [24]. Given the increasing consumption of video content, leveraging video marketing across various platforms is vital 24.

Cultivating an email database remains a highly effective strategy for direct communication and nurturing customer relationships [24]. Business.govt.nz advises businesses to thoroughly understand their customers' needs and their decision-making processes, build a strong and recognisable brand, research where their target audience gathers information, and be prepared to adapt their strategies to changing market conditions [42].

Open Expert highlights the importance of optimising a Google My Business listing, focusing on local SEO with location-specific keywords, actively engaging with customers on relevant social media platforms using local targeting, creating valuable and locally relevant content, strategically balancing push and pull marketing tactics, and actively engaging with the local community to build strong relationships [40].

Activate.co.nz suggests that small businesses should ensure their website is user-friendly, mobile-responsive, and optimised for local SEO with a .co.nz domain. They also recommend starting a blog with relevant keywords, creating engaging video content, leveraging user-generated content, focusing on the social media platforms where their target audience is most active, using Google Ads with location-based targeting, building an email list with incentives, and considering the integration of sustainable marketing practices [41].

Quest.net.nz emphasises that New Zealand consumers appreciate authenticity, storytelling that resonates with Kiwi culture and history, inclusivity in marketing campaigns, and a demonstrated commitment to environmental awareness. They also highlight the dominance of digital channels in reaching nz consumers [43].

A successful marketing strategy in New Zealand for 2025 necessitates a comprehensive approach that integrates a variety of online and potentially offline tactics, with a strong emphasis on digital channels given the high internet penetration. Local relevance and authenticity are key to building trust and effectively resonating with Kiwi consumers.

Small businesses in particular should prioritise optimising for local search engines and building a strong presence on platforms like Google My Business to capture local search traffic and connect with customers in their immediate area.

Encouraging online reviews is crucial for establishing credibility and influencing purchasing decisions. Video marketing and content marketing initiatives, such as maintaining a blog and creating valuable resources, are powerful tools for engaging New Zealand consumers, establishing a business as a thought leader in its industry, and driving organic traffic to its online platforms. All content should be relevant, informative, and specifically tailored to the interests and needs of the identified target audience.

Navigating the Opportunities and Challenges of Digital Marketing in NZ in 2025

Key Takeaways and Recommendations for New Zealand Marketers

The digital marketing landscape in New Zealand for 2025 is characterised by continued digital dominance, the increasing integration of AI, the pervasive influence of video content, and a growing consumer expectation for personalisation and sustainability. While economic pressures and fluctuating consumer sentiment present ongoing challenges, they also create opportunities for marketers to connect with their audience on a deeper level by addressing their concerns and providing value.

The digitally engaged population of New Zealand, coupled with the increasing sophistication of digital marketing tools and techniques, offers significant potential for businesses to grow and thrive.

To navigate this landscape successfully, NZ marketers are recommended to:

- invest time and resources in understanding and implementing AI tools to enhance operational efficiency and deliver more personalised customer experiences;

- prioritise video marketing across both short-form and long-form formats to capture the attention of New Zealanders on their preferred platforms;

- focus on creating authentic and locally relevant content that resonates with Kiwi values and culture;

- embrace sustainable marketing practices to align with the growing environmental consciousness of consumers;

- continuously monitor key economic indicators and shifts in consumer sentiment to ensure their marketing strategies remain relevant and effective;

- build and optimise their local online presence through diligent SEO efforts and a well-managed Google Business Profile;

- and leverage data analytics to gain deeper insights into customer behaviour and to continuously refine and optimise their marketing campaigns for maximum impact.

In conclusion, the digital marketing environment in New Zealand in 2025 presents both challenges and considerable opportunities. By staying informed about the key trends, effectively leveraging data, and adopting innovative and adaptable marketing strategies, NZ marketers can successfully connect with their audience and achieve their business objectives in the year ahead.

And yes, we offer training courses to help you take advantage of opportunities and achieve your goals in 2025, including:

Mastering Digital Marketing

If you'd like to learn more about actionable digital marketing strategies for the year ahead, click here to check out our NZ Digital Marketing Essentials 2025 online training course: https://netmarketingcourses.co.nz/courses/nz-digital-marketing-essentials/

--

Want to know how NZ small businesses can master Digital Marketing?

This course has been specifically crafted for Kiwi business owners who want real, practical results – not just marketing theory.

As a small business owner in New Zealand, you face unique challenges: a smaller market, tight budgets, limited time, and the constant pressure of competing with both local and international players. The good news? Your size and local presence can be your greatest advantage – if you know how to leverage them effectively.

This comprehensive course cuts through the overwhelming world of digital marketing to deliver exactly what you need to know, tailored specifically for the New Zealand market. You’ll learn practical, proven strategies that work for businesses your size, in your market.

Click here to check out our online training course, Practical Digital Marketing for NZ Small Business.

--

Check out our other courses:

Certificate in Digital Marketing

This comprehensive Digital Marketing course is designed for marketers at any level (from junior to senior) who want to acquire comprehensive training in all aspects of Digital Marketing based on the latest technologies.

This online course draws on the latest developments in Digital Marketing, covering key competencies and new and emerging technologies.

For more details of the Certificate in Digital Marketing online course, please click here.

—

Digital Marketing 101

Digital Marketing 101 is an extrended online training course designed for students who may know very little about Digital Marketing, touching on a wide range of Digital Marketing topics.

For more information about Digital Marketing 101, please click here.

--

We also have special courses for:

NZ Local Government Digital Marketing Essentials 2025

NZ Public Sector (Central Government) Digital Marketing 2025

--

If you’d like to learn more about Social Media Marketing in New Zealand, check out our online training courses:

All our courses are developed specifically for New Zealand conditions and are freshly updated for 2025.

Here are the current courses (click on the links for more details about each course):

—

SOCIAL MEDIA MARKETING COURSES

The Principles & Practice of Social Media Marketing

For those new to Social Media Marketing: this is a thirteen-part eCourse providing a comprehensive introduction to Social Media Marketing, from the Basics to detailed instructions on how to build and run a Social Media Marketing programme.

For more details of the Social Media Marketing online course, please click here.

—

We also have a course that will help you master both of New Zealand’s most powerful social media:

By far the most powerful social media channels for NZ marketers these days are Facebook and Instagram.

That’s where the audiences are, and that’s where YOU need to be.

Of course, there’s rather more to Facebook and Instagram marketing than making a few posts or taking a few pretty pictures and hoping to reach large numbers of your target audience.

Effective social media marketing requires the right knowledge, tools, tips and techniques to help you get noticed and to encourage your audience to engage with you and your brand.

That’s where we can help.

In recognition of the combined strengths of Facebook and Instagram, we’ve taken the best of our popular Facebook and Instagram courses, and blended them together into a powerful thirteen-part Complete Facebook and Instagram Marketing online training course.

This combined course will bring you up to speed with what’s required to make your social media marketing on Facebook and Instagram really work for you in 2025.

—

Writing for the Web course

Effective writing has become an absolutely core competency when communicating online. Not just any writing, however. Different media require different approaches. The headline that might have looked wonderful in the newspaper probably won’t fit within the constraints of Facebook or Instagram character counts.

Oh, and you’ll probably want to know how to make best use of AI writing tools such as ChatGPT, Jasper AI and the many other AI enhancements for online writing.

Our Writing for the Web course covers the key elements you need to know to communicate effectively to online audiences.

For more information about our Writing for the Web course, please click here.

—

Online Video Marketing course

Online Video is now New Zealand’s most popular broadcast medium, with YouTube alone reaching more than half the country on a daily basis (according to research by NZ On Air).

And online video is a powerful way to communicate your brand story, explain your value proposition, and build relationships with your customers and prospects.

Remember the old cliche that a picture is worth a thousand words? According to an estimate by Dr James McQuivey of Forrester Research, one minute of video is equal to 1.8 million words.

So let’s cut to the chase. It’s well past time for you to upskill yourself in online video marketing. That’s why we have a course on the topic, which covers both standard and vertical videos (landscape, square and portrait) and also some of the AI tools that have sprung up to make video creation easier than ever.

For more details of the Online Video Marketing course, please click here.

—

AI for Marketers

As you will no doubt have noticed, Artificial Intelligence has developed a more and more prominent role in marketing in 2025, across all aspects of digital marketing.

We’ve been building AI coverage into all of our courses but we also have a dedicated AI for Marketers online training course which will help you master a wide range of AI tools to do what previously had to be done more manually.

For more information about our AI for Marketers course, please click here.

—

—

Works cited in this article:

-

Digital 2025: New Zealand — DataReportal – Global Digital Insights, accessed on March 21, 2025, https://datareportal.com/reports/digital-2025-new-zealand

-

NZIER Consensus Forecasts suggest a contraction in the New Zealand economy in the year ending March 2025, accessed on March 21, 2025, https://www.nzier.org.nz/publications/nzier-consensus-forecasts-suggest-a-contraction-in-the-new-zealand-economy-in-the-year-ending-march-2025

-

New Zealand: Staff Concluding Statement of the 2025 Article IV Mission, accessed on March 21, 2025, https://www.imf.org/en/News/Articles/2025/03/11/cs-031125-new-zealand-staff-concluding-statement-of-the-2025-article-iv-mission

-

Economic outlook brighter for 2025 with 2.5% growth forecast - Westpac | RNZ News, accessed on March 21, 2025, https://www.rnz.co.nz/news/business/541579/economic-outlook-brighter-for-2025-with-2-point-5-percent-growth-forecast-westpac

-

Economic challenges dampen New Zealand business optimism | NZ Adviser, accessed on March 21, 2025, https://www.mpamag.com/nz/news/general/economic-challenges-dampen-new-zealand-business-optimism/529158

-

NZ Economic Overview February 2025 - Westpac IQ, accessed on March 21, 2025, https://www.westpaciq.com.au/economics/2025/02/nz-economic-overview-february-2025

-

New Zealand consumer confidence rises heading into 2025 | NZ Adviser, accessed on March 21, 2025, https://www.mpamag.com/nz/news/general/new-zealand-consumer-confidence-rises-heading-into-2025/518734

-

Westpac McDermott Miller Consumer Confidence, December quarter 2024, accessed on March 21, 2025, https://www.westpaciq.com.au/economics/2024/12/westpac-mcdermott-miller-consumer-confidence-december-quarter-2024

-

New Zealand Westpac Consumer Sentiment - Investing.com, accessed on March 21, 2025, https://www.investing.com/economic-calendar/westpac-consumer-sentiment-357

-

New Zealand Consumer Confidence - Trading Economics, accessed on March 21, 2025, https://tradingeconomics.com/new-zealand/consumer-confidence

-

In Q1 2025, New Zealand's consumer confidence index dropped to 89.2 amid economic pressures - VT Markets, accessed on March 21, 2025, https://www.vtmarkets.com/live-updates/in-q1-2025-new-zealands-consumer-confidence-index-dropped-to-89-2-amid-economic-pressures/

-

Westpac McDermott Miller Consumer Confidence, March quarter 2025, accessed on March 21, 2025, https://www.westpaciq.com.au/economics/2025/03/westpac-mcdermott-miller-consumer-confidence-march-quarter-2025

-

New Zealanders Spending More Time Online Than Ever - InternetNZ | Scoop News, accessed on March 21, 2025, https://www.scoop.co.nz/stories/SC2503/S00036/new-zealanders-spending-more-time-online-than-ever-internetnz.htm

-

The search for value continues - NZ Post Business IQ, accessed on March 21, 2025, https://www.nzpostbusinessiq.co.nz/latest-ecommerce-insights/search-value-continues

-

Retail predictions for 2025 | Shippit NZ, accessed on March 21, 2025, https://www.shippit.com/nz/blog/retail-predictions-for-2025

-

The Future of E-Commerce in New Zealand: 2025 Trends and How to Stay Ahead, accessed on March 21, 2025, https://www.clickncall.co.nz/the-future-of-e-commerce-in-new-zealand-2025-trends-and-how-to-stay-ahead/

-

Three consumer trends to track in 2025 | NZMP.com, accessed on March 21, 2025, https://www.nzmp.com/global/en/news/consumer-trends-2025.html

-

Social Media Stats New Zealand, accessed on March 21, 2025, https://gs.statcounter.com/social-media-stats/all/new-zealand

-

NZ Social Media Statistics 2025 - SocialMedia.org.nz, accessed on March 21, 2025, https://socialmedia.org.nz/nz-social-media-statistics-2018/

-

Social Media Marketing: More Important Than Ever in 2025 - SocialMedia.org.nz, accessed on March 21, 2025, https://socialmedia.org.nz/social-media-marketing-more-important-than-ever-in-2025/

-

NZIE® - The State of Social 2025, accessed on March 21, 2025, https://www.nzie.ac.nz/blog-the-state-of-social-2025/

-

A Guide To Email Marketing Laws In New Zealand (2025 Updated) | Sprintlaw NZ, accessed on March 21, 2025, https://sprintlaw.co.nz/articles/email-marketing-laws/

-

You Should Know These Email Marketing Stats in 2025 - Shopify, accessed on March 21, 2025, https://www.shopify.com/blog/email-marketing-statistics

-

Ten digital marketing strategies for NZ businesses (2023 updated), accessed on March 21, 2025, https://tractionmarketing.nz/10-digital-marketing-strategies-for-nz-businesses/

-

Email Marketing Benchmarks 2025 - MoEngage, accessed on March 21, 2025, https://www.moengage.com/benchmarks/email-benchmarks-2025/

-

How to Calculate Email Marketing Conversion Rates in 2025, accessed on March 21, 2025, https://webzilla.co.nz/how-to-calculate-email-marketing-conversion-rates-in-2025/

-

Top 9 NZ Digital Marketing Trends In 2025, accessed on March 21, 2025, https://rankrush.co.nz/top-9-nz-digital-marketing-trends-in-2025/

-

11 Top Video Marketing Trends for Ecommerce Businesses (2024) - Shopify New Zealand, accessed on March 21, 2025, https://www.shopify.com/nz/blog/video-marketing-trends

-

The Rise of Video-First Marketing: Creating Effective Video Ads for NZ Audiences, accessed on March 21, 2025, https://lucidleads.co.nz/the-rise-of-video-first-marketing-creating-effective-video-ads-for-nz-audiences/

-

MARKETING TRENDS TO WATCH IN NEW ZEALAND IN 2024 - Momentum Consulting, accessed on March 21, 2025, https://www.momentum.co.nz/marketing-trends-to-watch-in-new-zealand-in-2024

-

The Rise of AI in Digital Marketing: What it Means for NZ Businesses | Mogul, accessed on March 21, 2025, https://mogul.nz/blog/the-rise-of-ai-in-digital-marketing-what-it-means-for-nz-businesses/

-

NZIE® - AI in Marketing Course, accessed on March 21, 2025, https://www.nzie.ac.nz/short_course/ai-in-marketing-course/

-

A.I. Marketing New Zealand | Digital Agency, accessed on March 21, 2025, https://www.aimarketing.co.nz/

-

Nielsen data shows financial sector ad spend rise in NZ amid shifting consumer sentiment and growing economic pressures, accessed on March 21, 2025, https://www.nielsen.com/news-center/2025/nielsen-data-shows-financial-sector-ad-spend-rise-in-nz-amid-shifting-consumer-sentiment-and-growing-economic-pressures/

-

Nielsen Data Shows Financial Sector Ad Spend Rise In NZ Amid Shifting Consumer Sentiment And Growing Economic Pressures - Scoop, accessed on March 21, 2025, https://www.scoop.co.nz/stories/BU2503/S00317/nielsen-data-shows-financial-sector-ad-spend-rise-in-nz-amid-shifting-consumer-sentiment-and-growing-economic-pressures.htm

-

Nielsen Ad Intel 2024 Advertising Spend Report reveals New Zealand's top advertisers, leading industries, and market shifts, accessed on March 21, 2025, https://www.nielsen.com/news-center/2025/nielsen-ad-intel-2024-advertising-spend-report-reveals-new-zealands-top-advertisers-leading-industries-and-market-shifts/

-

Nielsen reveals NZ's top advertisers in latest report - stoppress.co.nz, accessed on March 21, 2025, https://stoppress.co.nz/news/nielsen-reveals-nzs-top-advertisers-in-latest-report/

-

New Zealand insurers boost ad spend amid market growth, accessed on March 21, 2025, https://www.insurancebusinessmag.com/nz/news/breaking-news/new-zealand-insurers-boost-ad-spend-amid-market-growth-529147.aspx

-

Australian and New Zealand ad markets maintain growth in 2024 – MAGNA Global Ad Forecasts - Campaign Brief WA, accessed on March 21, 2025, https://wa.campaignbrief.com/australian-and-new-zealand-ad-markets-maintain-growth-in-2024-magna-global-ad-forecasts/

-

Effective Local Marketing Strategies for New Zealand Businesses - OpenExpert, accessed on March 21, 2025, https://openexpert.nz/business/effective-local-marketing-strategies-for-new-zealand-businesses/

-

Master Small Business Marketing in NZ: A Step-by-Step Guide - Activate Design, accessed on March 21, 2025, https://www.activate.co.nz/Blog/How-to-Master-Small-Business-Marketing-in-New-Zealand-A-Comprehensive-Step-by-Step-Guide/

-

How marketing sets you up for success — business.govt.nz, accessed on March 21, 2025, https://www.business.govt.nz/business-performance/marketing-strategy/how-marketing-sets-you-up-for-success

-

Captivating the Kiwi Heart: NZ marketing must dos - Quest, accessed on March 21, 2025, https://www.quest.net.nz/captivating-the-kiwi-heart-nz-marketing-essentials/